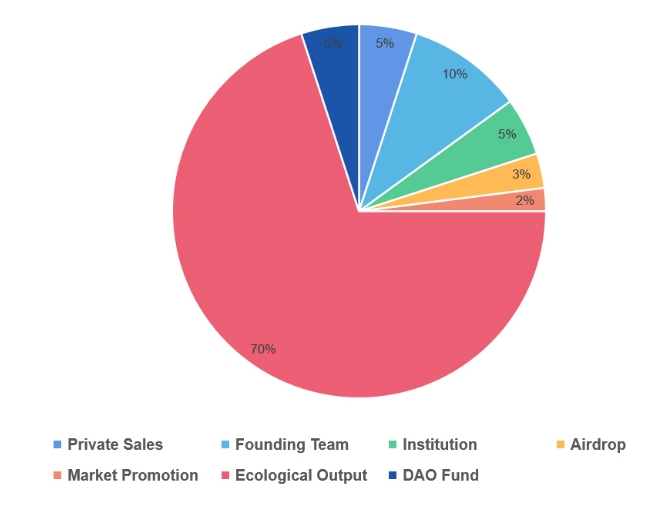

$XMETA Token Allocation

Break through the WEB3.0 prisoner's dilemma and achieve a fair distribution of tokens.

"How should native tokens be distributed fairly?" is not a highly complex question. A fair token issuance should achieve some goals.

First, the tokens should be distributed to the "right people". Here, the right people refer to those participating users, who generally align with the best interests of the protocol. They will support the community over the long term, actively participate, and contribute value to the ecosystem.

Second, the token price discovery process does not seriously damage the portfolio of its holders. This needs to be guaranteed with sufficient liquidity (number of tokens at a particular price) and float (defined here as a percentage of the total token supply available). On this basis, market supply and demand can be absorbed almost from the first day.

The DeFi summer market is turning around in 2020, it uses a combination of Automated Money Markets (AMMs) and other DeFi primitives to unlock new models such as Initial Decentralized Exchange Offerings (IDOs), liquidity mining programs, auctions and more new models. It brings a boom with high-yield liquidity mining.

In 2021, the previous airdrop model was improved, NFTs gained mainstream recognition and adoption, and whitelisted sales were introduced. New token allocations are not just about bootstrapping initial liquidity, but also leveraging tokens to gain long-term community membership.

With this increased liquidity, the protocol can be more selective and better engage long-term stakeholders.

The distribution of $XMETA tokens is as follows:

The total initial issuance is 300 million

Private Sales 5% 15 million

Founding Team 10% 30 million

Institution 5% 15 million

Market Promotion 2% 6 million

Airdrop 3% 9 million

DAO Fund 5% 15 million

Ecological Output 70% 210 million

Last updated